Running a small business often means wearing multiple hats managing sales, clients, staff, and operations. Amidst the daily hustle, one crucial aspect often gets overlooked: your business’s financial health.

Just like our bodies need regular check-ups to stay healthy, your business finances deserve the same care and attention. A monthly financial health check is a simple yet powerful way to ensure that your business remains sustainable, compliant, and growth-ready.

At Priority1 Group, we help small business owners across Australia stay in control of their numbers with expert bookkeeping, digital marketing, and website development solutions. This guide walks you through everything you need to know about conducting monthly financial reviews and why they’re essential for long-term success.

A business health check is essentially a regular review of your company’s financial position assessing your income, expenses, assets, and liabilities. For small businesses, it can be the difference between stability and a cash flow crisis.

Here’s why monthly financial reviews are essential:

By implementing a simple but consistent review system, small business owners can gain complete visibility into how their business is performing month after month.

Think of your financial health check as a monthly “snapshot” that reflects the true condition of your business. It’s not just about profit or loss it’s about financial resilience.

When done right, these reviews:

Ultimately, your goal is to move from reactive accounting to proactive financial management.

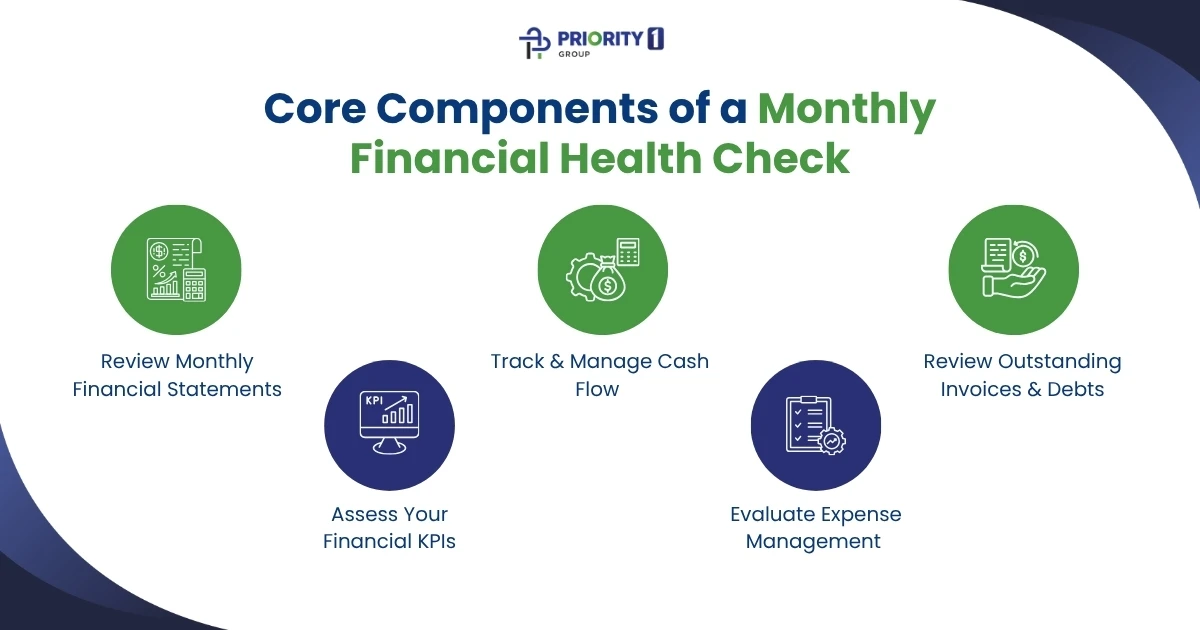

To make financial health checks effective, you’ll need a structured process. Below are the key areas to review each month.

Start by reviewing your Profit & Loss, Balance Sheet, and Cash Flow Statement.

These three documents form the foundation of your business’s financial story:

A monthly financial statements small business guide can help you interpret these figures effectively. If you’re unsure where to begin, an experienced bookkeeping partner like Priority1 Group can help you generate, reconcile, and analyse these reports accurately every month.

Healthy cash flow management keeps your operations running smoothly. Even profitable businesses can struggle if cash isn’t coming in on time.

A monthly review should answer questions like:

By forecasting future cash inflows and outflows, you can predict slow periods and prepare accordingly. Tools like Xero and QuickBooks simplify this by giving you real-time insights into your finances, allowing you to stay one step ahead.

Late payments are one of the most common causes of small business stress.

Make it a habit to check unpaid invoices and follow up on overdue accounts. A clear debtor management strategy improves your cash position and reduces the risk of bad debts.

Monthly bookkeeping tasks small business owners should prioritise include:

If you find this process overwhelming, consider outsourcing it. Professional bookkeepers can automate invoicing reminders, reconcile payments, and ensure your accounts stay accurate, freeing you to focus on running your business.

Numbers mean little without context. That’s where financial KPIs for small business owners come in. Tracking key metrics helps you understand if your business is performing as expected.

Some crucial KPIs include:

KPI | What It Measures | Ideal Benchmark |

Gross Profit Margin | Profit after deducting direct costs | 50%+ (varies by industry) |

Operating Expenses Ratio | Expenses compared to revenue | <30% |

Current Ratio | Liquidity and ability to pay short-term debts | >1.2 |

Accounts Receivable Days | How quickly you collect payments | <30 days |

ROI (Return on Investment) | Efficiency of marketing and spending | Positive trend |

Monitoring these KPIs monthly helps ensure your business remains financially stable and signals when it’s time to adjust budgets or spending.

Every dollar counts for small businesses. Review your expenses monthly to identify unnecessary costs or subscriptions you no longer use.

Start by grouping expenses into categories such as:

By maintaining clear visibility over these areas, you can optimise spending and reallocate funds to more productive areas. A good financial monitoring system will automate this categorisation for you reducing manual errors and saving time.

Consistency is key to success. Establishing a structured routine ensures you never miss an important financial checkpoint.

Here’s a Monthly Financial Health Checklist for Small Business Owners:

Completing this process each month will not only improve accuracy but also reduce stress during quarterly or annual reporting.

If you prefer hands-off management, Priority1 Group’s bookkeeping team can handle these reviews for you, ensuring your financials stay updated and compliant.

Technology has made financial management smarter and faster. Cloud-based financial monitoring systems like Xero, MYOB, and QuickBooks provide real-time data, automate bookkeeping tasks, and integrate seamlessly with CRMs and POS systems.

Benefits of adopting these tools include:

For instance, a small café can use Xero to track daily sales, monitor cash flow, and compare month-to-month performance effortlessly.

With expert setup and ongoing support from Priority1 Group, you can make technology your best business partner.

While financial health is essential, your business’s digital and operational health also plays a critical role in sustainability.

A well-functioning website and an effective marketing strategy directly influence your revenue. If your website is outdated or your online visibility is low, your financials will eventually reflect that gap.

At Priority1 Group, we go beyond bookkeeping offering:

When these three pillars work together, your business stays financially healthy and growth-ready.

Many small business owners manage their own accounts initially, but as operations expand, so does the complexity. If you notice any of the following, it may be time to seek professional assistance:

Outsourcing your bookkeeping ensures compliance, accuracy, and time savings. Professionals can identify trends, provide monthly insights, and help you plan strategically for the future.

Priority1 Group’s outsourced bookkeeping services are tailored to Australian small businesses, helping you maintain financial clarity without the stress of managing spreadsheets yourself.

At Priority1 Group, we understand that every small business is unique, which is why our solutions are designed to support you across multiple fronts:

We work as your behind-the-scenes business partner, simplifying financial management, improving efficiency, and ensuring your business stays on track month after month.

Your business is an evolving organism and just like any living system, it needs care and regular attention. Conducting monthly financial reviews ensures you catch red flags early, maintain cash flow stability, and set your business up for lasting growth.

Remember, success isn’t just about revenue, it’s about understanding where your money goes, how it works for you, and how to keep it moving in the right direction.

Let Priority1 Group help you take the guesswork out of your finances and build a stronger, smarter, and healthier business.

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2025 All Rights Reserved.