For Australian NDIS providers, payroll compliance is more than an administrative task; it is a core component of regulatory accountability. During NDIS auditing, payroll records are closely examined to ensure providers meet employment obligations, protect workers’ rights, and maintain transparent financial management.

Because most NDIS providers operate under the SCHADS Award (Social, Community, Home Care and Disability Services Industry Award), payroll errors can quickly escalate into serious compliance breaches. Underpayments, incorrect classifications, or unpaid superannuation can trigger audit findings, financial penalties, or even impact your NDIS registration.

If you are preparing for an NDIS payroll audit, understanding what auditors review and how to prepare can significantly reduce risk.

The NDIS audit process is designed to ensure registered providers comply with the NDIS Practice Standards and Quality Indicators.

Depending on your registration level and risk profile, providers may undergo:

Each audit may include financial and payroll record checks, particularly where staff deliver direct participant supports.

Payroll intersects with:

Because workforce costs are one of the largest expenses for NDIS providers, auditors prioritise payroll accuracy during the NDIS audit process.

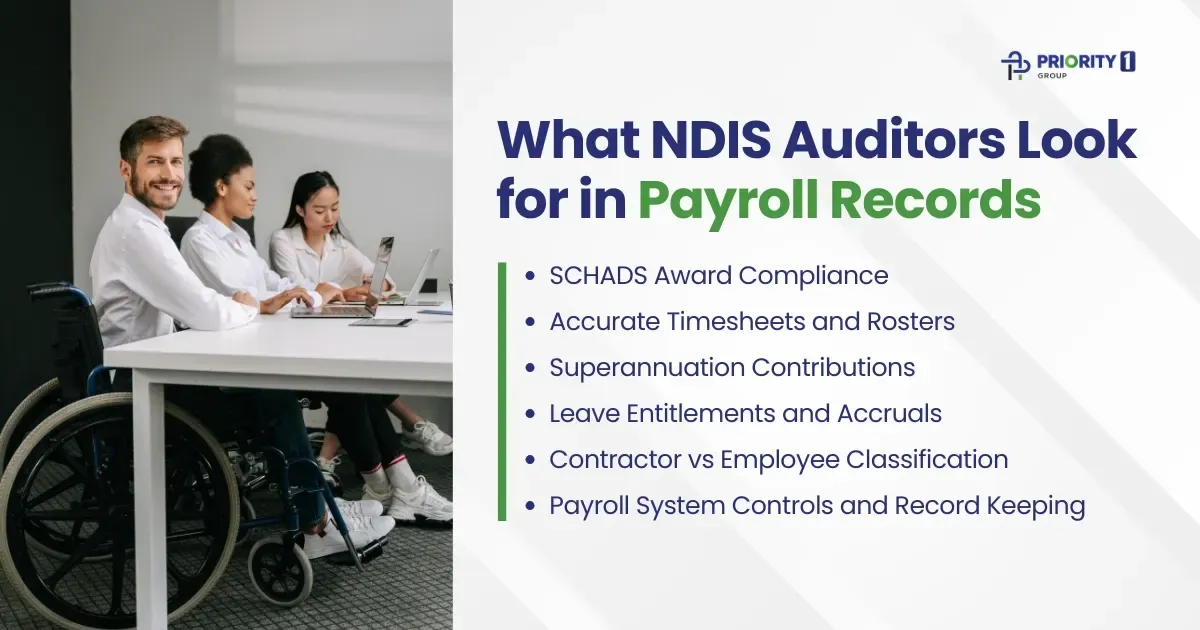

When conducting NDIS auditing, auditors typically request a sample of employee files and payroll reports. Here’s what they focus on:

One of the most scrutinised areas is whether employees are paid correctly under the SCHADS Award.

Auditors will check:

Misclassification of employees is one of the most common compliance issues found during an NDIS payroll audit.

Auditors often compare:

They look for consistency between hours worked, hours billed, and hours paid. Any discrepancies may raise compliance concerns.

Electronic timesheet systems with approval workflows are generally viewed more favourably than manual processes due to stronger audit trails.

Superannuation compliance is another critical review point.

Auditors assess:

Late or underpaid superannuation contributions can trigger regulatory scrutiny beyond the NDIS Commission.

Auditors examine whether leave is accrued and paid correctly, including:

Incorrect leave calculations may indicate systemic payroll errors.

Improper worker classification is a significant compliance risk.

Auditors may review:

If a contractor arrangement resembles employment, this may be considered non-compliant under Fair Work obligations.

The NDIS requires providers to maintain accurate records for at least seven years.

Auditors assess:

Strong internal controls demonstrate proactive compliance management.

Many audit findings stem from avoidable payroll errors. Common issues include:

Addressing these issues before an audit can significantly reduce compliance risk.

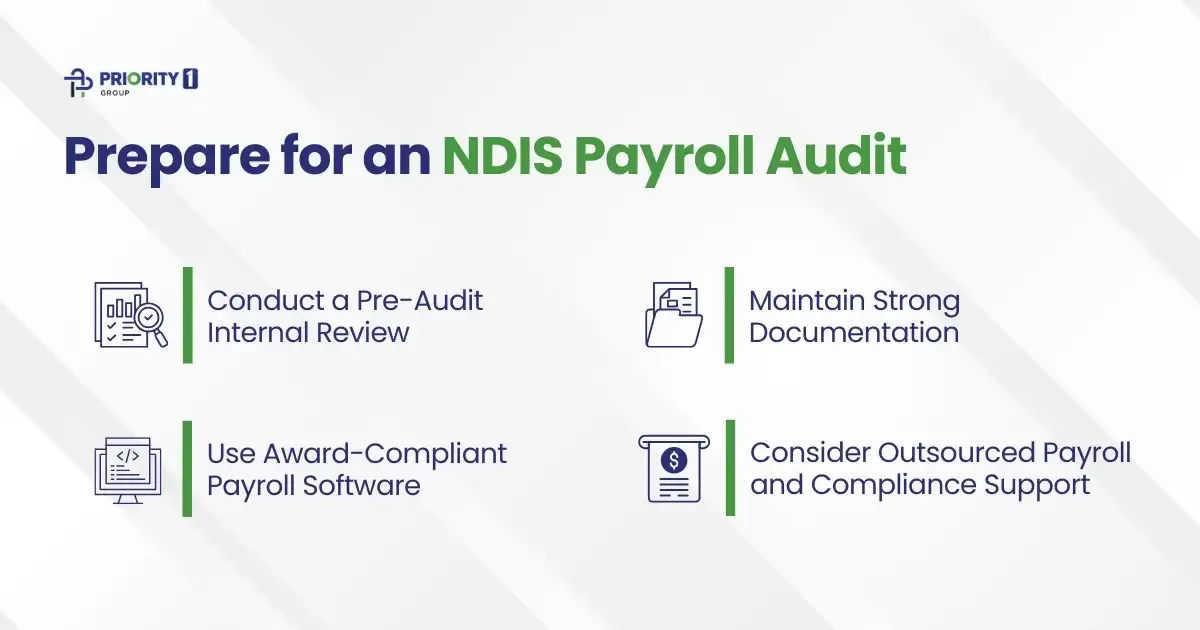

Preparation is the most effective way to navigate the NDIS audit process confidently.

Before your scheduled audit:

A structured pre-audit check can identify errors before auditors do.

Ensure you can readily provide:

Well-organised documentation reduces audit stress and demonstrates professionalism.

Modern payroll systems that interpret SCHADS Award rules can help reduce manual errors. Automated calculations, built-in compliance updates, and digital audit trails strengthen your position during NDIS auditing.

Many Australian NDIS providers choose to outsource payroll and bookkeeping due to the complexity of compliance requirements.

As an NDIS-focused outsourcing partner, Priority1 Group supports providers with:

Outsourcing reduces administrative burden and enhances audit readiness.

Failing a payroll review during an NDIS audit can result in:

Proactive payroll compliance protects both your organisation and your participants.

Navigating an NDIS payroll audit can be overwhelming — especially with the complexities of SCHADS Award interpretation, superannuation compliance, and strict record-keeping obligations. That’s where Priority1 Group steps in as a trusted B2B outsourcing partner for Australian NDIS providers.

As a specialised NDIS outsourced company, Priority1 Group delivers structured, compliance-focused solutions designed to reduce risk and improve operational efficiency.

Priority1 Group helps providers strengthen payroll systems before issues arise by offering:

By ensuring payroll accuracy from the outset, providers can confidently approach the NDIS audit process without last-minute stress.

Use this quick-reference checklist to assess your readiness:

✔ Employee contracts signed and compliant

✔ Correct SCHADS classifications applied

✔ Accurate penalty rate calculations

✔ Superannuation paid on time

✔ Leave balances correctly accrued

✔ Timesheets aligned with service delivery

✔ Payroll reconciled to financial statements

✔ Records retained for at least seven years

✔ Contractor arrangements reviewed

✔ Clear audit trail within payroll system

Payroll compliance is one of the most scrutinised elements of NDIS auditing in Australia. With complex SCHADS Award requirements and strict regulatory oversight, even minor payroll errors can lead to significant consequences.

By implementing strong internal controls, maintaining accurate documentation, and considering expert outsourcing support, NDIS providers can confidently navigate the NDIS audit process.

Audit readiness is not about reacting when auditors arrive it is about building compliance into your systems from the start.

Typically, auditors request employment contracts, payslips, timesheets, superannuation reports, leave records, payroll summaries, and evidence of SCHADS Award compliance.

Most registered providers are audited at initial registration and renewal (usually every three years), with possible mid-term audits depending on risk profile.

Providers may receive corrective action requests. Serious breaches can lead to penalties, back payments, or regulatory escalation.

If employees fall under the SCHADS Award coverage, compliance is mandatory. Misclassification can result in underpayment claims.

Yes. Outsourcing reduces risk by ensuring payroll is managed by professionals familiar with award interpretation, Fair Work obligations, and the NDIS audit process.

38B Douglas Street, Milton QLD, 4064 Australia

Monday - Friday 09:30 AM - 05:30 PM

© 2026 All Rights Reserved.